Computer depreciation rate

This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual depreciation. If the computer has a residual value in 3 years of 200 then depreciation would be calculated.

Computer Related Equipment Depreciation Calculation Depreciation Guru

Computer depreciation rate This method starts by assuming a factor of depreciation rate as a percentage and each year the assets book value is depreciated by that percentage.

. The Canada Revenue Agency CRA considers some types of software to be of an enduring nature meaning it may continue to be. Not Book Value Scrap value Depreciation rate Where NBV is costs less accumulated depreciation. Below we present the more common classes of depreciable properties and their rates.

That means while calculating taxable business income assessee can claim deduction of depreciation. Depreciation allowance as percentage of written. 153 rows Control systems excluding personal computer s 10 years.

This could be on a straight-line basis which writes the asset off at 25 of. What is a sensible depreciation rate for laptops and computers. The rate of depreciation on computers and computer software is 40.

Block of assets. The formula to calculate depreciation through the double-declining method is. A good and oft-used rate is 25.

We also list most of the classes and rates at CCA classes. You need to know the full title Guide to depreciating assets 2022 of the publication to use this service. 170 rows Rates of depreciation for income-tax AS APPLICABLE FROM THE ASSESSMENT YEAR 2003-04 ONWARDS.

The computer will be depreciated at 33333 per year for 3 years 1000 3 years. Use our automated self-help publications ordering service at any time. Class 1 4 Class 3 5.

Alternatively you can depreciate the acquisition cost over a 5-year recovery period in the year you place the computer in service if you dont elect to expense any of the cost under section 179. Why Software Depreciates at Different Rates. If a company uses Written Down Value WDV method of depreciation it will need to calculate a new rate for depreciation to depreciate the asset over their remaining useful life.

Depreciation Chart As Per Companies Act Basics Depreciation Chart

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting Tally Taxation Tutorials

Depreciation Rate Formula Examples How To Calculate

Depreciation Rates Of Investments Download Table

Projectmanagement Com What Is Depreciation

How Long Does A Gaming Pc Last Statistics

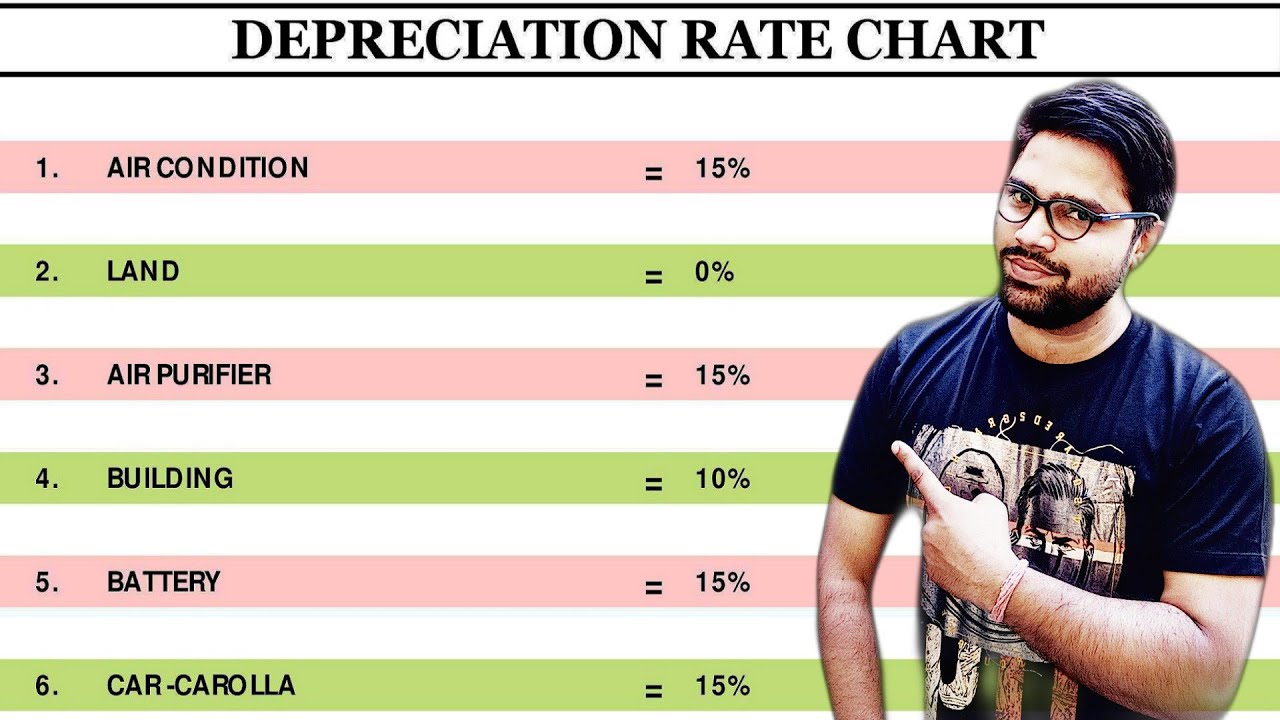

Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Dep Rate Chart Depreciation Youtube

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Method To Get Straight Line Depreciation Formula Bench Accounting

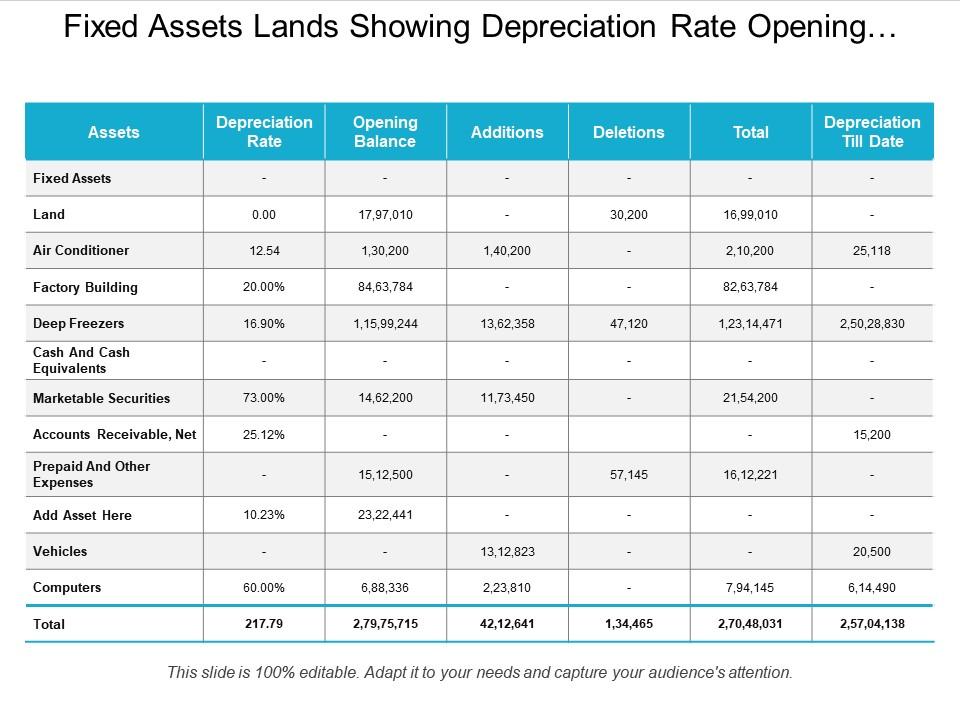

Fixed Assets Showing Depreciation Rate Opening Balance And Addition Templates Powerpoint Slides Ppt Presentation Backgrounds Backgrounds Presentation Themes

An Update On Depreciation Rates For The Canadian Productivity Accounts

Straight Line Depreciation Accountingcoach

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting Tally Taxation Tutorials

Different Methods Of Depreciation Calculation Sap Blogs

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

How Long Does A Gaming Pc Last Statistics